Disclaimer: The views and opinions expressed in this blog are entirely my own and do not necessarily reflect the views of my current or any previous employer. This blog may also contain links to other websites or resources. I am not responsible for the content on those external sites or any changes that may occur after the publication of my posts.

End Disclaimer

Today is where your (underwriting)book begins.

The rest is still unwritten.

-Natasha Bedingfield, Unwritten

Disclaimer #2: The one you will read

This post is for insurance and reinsurance underwriters (traders) and their C-Suite bosses who are open to and interested in finding new ways to make a lot of money.

All other people, you are free to ignore.

Unless, of course, you like making money too…

I’m going to give you one version of how the multiverse plays out in insurance and reinsurance underwriting.

A guess, a prognostication, a somewhat informed spaghetti throw against the wall.

I traded discretionary (qualitative-”I like (buy) NVDA, I don’t like (short) INTC”) and quantitative (don’t touch the model! algorithmic) strategies at banks and hedge funds from 1999-2016.

I made a lot of money trading.

I lost a lot of money trading.

I had some great mentors and teachers.

That was a good chunk of time to see the evolutions of things, in both the Darwinian and SEAL teams sense.

I was there when the trading floor went from writing paper tickets to paperless. I was there when trading went from a “you can’t trade lower than” 1/16 increments (a teeny in trading parlance), to completely digital, out-to-infinity decimal points.

Possibly most importantly for this context, I saw quantitative trading take its place alongside qualitative trading at shops that wanted a way to help add ostensibly uncorrelated returns.

Of course, I don’t have a full view of things, more of a flashlight in a dark room, a collection of mosaic tiles - sprinkled by conferences, what my friends are doing at other places, and by what companies trying to hire me want to do in the future.

But most of all, my view is informed by the sheer immutable, overwhelmingly obvious and logical pathway of what’s going to happen in underwriting in the industry as AIML technology evolves and is adopted.

Cassandra wound up being right- about the Trojan Horse, about her brother dying- all of it. But it was too late- cursed by Apollo to have no one believe her after spurning his advances but still accepting his gift of prophecy, she was murdered by Agamemnon’s first wife, Clytemnestra.

Bummer.

I’m no Cassandra. No one will remember, let alone invoke my name in the future to try to hammer home a point.

But I’m going to make some prophecies all the same.

Here we go.

Here’s how the future will be underwritten

(Re)Insurance Underwriting is a very difficult type of trading

Let’s start with and agree upon one very important prerequisite.

Insurance and reinsurance underwriting is a particularly difficult type of trading.

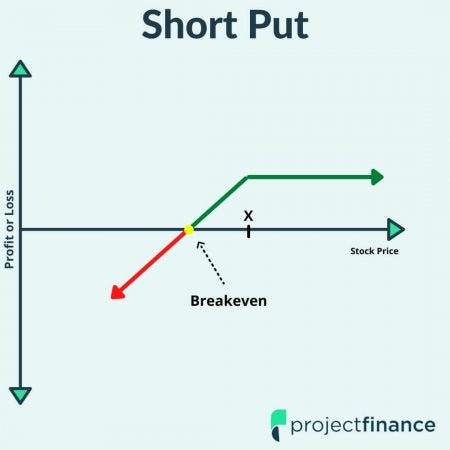

In option trading this is called put selling, or being short puts. Both (re)insurance underwriting and option put-selling accept premium up front to take on downside risk. Both are predicated on the ability to analyse the probability of “downside events”.

Both have a terrible return stream asymmetry of “drip drip drip premium in, blow-up money out, drip drip drip premium in, blow-up money out”.

I didn’t know a lot of traders who were pure put sellers, maybe because they didn’t last all that long and maybe because no bank or hedge fund I was at had the stomach for that return stream.

All of this to say-

Underwriting is hard.

Were I an underwriter(insurance trader), I would do everything in my power to put all the odds in my favor in order “to crush my enemies and see them driven before me.” (Conan the Barbarian 1982, I thank you for your wellspring of quotes)

Luckily there’s a thing for that. Well a couple things.

Discretionary and Quantitative Trading have coexisted(thrived!) for Decades at Banks and Hedge Funds

Quantitative trading has been around in finance since at least the ~1960’s( or the 50’s if you include/consider Markowitz efficient frontier and mean variance optimization ideas).

Ed Thorpe was one of the first to apply quantitative strategies to the financial markets. He co-founded perhaps what could be considered the first quantitative hedge fund, Princeton/Newport Partners in 1974, and for many many years achieved very large returns.

Some time later in 1984, Renaissance Technologies (RenTec) began plucking PhDs from physics and other hard sciences, where they cut and pasted methods from their old domains into trading, to hyperbolic, hard-to-believe, excess returns.

So the takeaway is:

Quantitative analysis and implementation can revolutionize trading practices.

Thorp and RenTec identified and exploited inefficiencies in the market long before most of Wall Street began to leverage complex mathematical strategies.

They made money for a long time before “everybody else caught on”.

Will (Re)Insurance do the same?

There’s another more recent thing, which stands on the shoulders of decades of work in natural language processing, computational linguistics, and neural networks called…wait for it…Generative AI.

You may have heard of it.

Generative AI will pull old-school discriminative machine learning across the finish line and allow it’s adoption into insurance quant trading .

Underwriting will move to a mixture of human only, human & algorithmic/AI (bionic), and algorithmic/AI only(ish).

I will use the terms AI and algorithm(ic) somewhat interchangeably as I consider the unspecific catch-all term of “AI” to encompass all the various recipes (algorithms) and series of steps necessary for doing things faster, at scale, and more precisely when applied to a domain, in this case Insurance and Reinsurance underwriting.

Another quick note on the differentiation between algorithmic and AI adoption in Insurance and Reinsurance:

Data, data, data, feeds the models.

Reinsurers have it much tougher than Insurers regarding data quality and stitching together a cohesive data narrative.

This is, in part, a function of the Insurer/Broker/Reinsurance sandwich.

Insurers are the client, not the Reinsurers.

There is no incentive to stitch together an end-to-end standardized data schema across all parties.

Generative AI will be a Trojan Horse for Discriminative Machine Learning

About 2 years ago, large language models jumped into the zeitgeist and the masses at large were able to, in a way, implicitly “get” how AI could work for them, not in the technical “optimising with backpropagation will help me” way, but in the visceral “holy cow look what this thing made for me” way.

The barrier to entry was lowered.

The confusing nomenclature abstracted away behind the scenes.

Things became more tangible.

Generative AI will be the Trojan Horse for how practical, effective old-school discriminative machine learning (classification and regression) evolves into insurance quant trading.

Except now it won’t be “Beware the Greeks” bearing gifts, it will be “embrace the Geeks” bringing discriminative models as part and parcel with your GenAI requests.

“Oh, you want a chatbot? Have I shown you how we can predict how severe your claim will be?”

“You said you want to do RAG across a silo of your data for that LOB? Have you seen our classification model predicting whether you would write that piece of business?”

“You like how we extracted all this submission data with an llm? Let me show you how to automate your risk selection with machine learning to the point where all you need is to give me a yes/no on each one.”

The differentiation of who trades what lines of business will be predicated upon the amount of data available, how homogeneous or commoditized the data is, and how bespoke/complex the deal making is.

Fac first, of course, followed by treaty.

I’ll take a stab at “who will trade what” in the future.

3 groupings:

Human Only. Human + AI. Mostly AI.

It’s just a guess people. A thought experiment.

(Send all angry emails to my old address at thequalitativeunderwriter@geocities.com.)

First the types of functions handled, then the lines of business:

The Functions:

The Lines of Business:

“The Way it’s Always Been Done”: An approach with an increasingly high rate of alpha decay

In the last 2 months I’ve met with two ‘real’ companies actively engaged in quantitative trading in insurance and reinsurance.

Soup-to-nuts models, chock full of discriminative machine learning with plenty of GenAI sprinkled on top.

One big company, one small company, but by all accounts, both smoking the market.

I got into reinsurance from hedge funds 8 years ago. I expected there to be quantitative trading, at least in pockets around the industry.

I was, and have been, more or less wrong about the rate of adoption of quantitative trading in (re)insurance .

The future is starting to look a lot different than the past.

Winter is just around the corner.

Stack the deck with methods and approaches that will give you an edge.

Seek novel alpha.

By Otakar’s Breath I beseech you!

Don’t slow down.